https://www.bea.gov/news/2020/gross-domestic-product-2nd-quarter-2020-advance-estimate-and-annual-update

Bureau of Economic Affairs

July 29, 2020

Gross Domestic Product, 2nd Quarter 2020 (Advance Estimate) and Annual Update

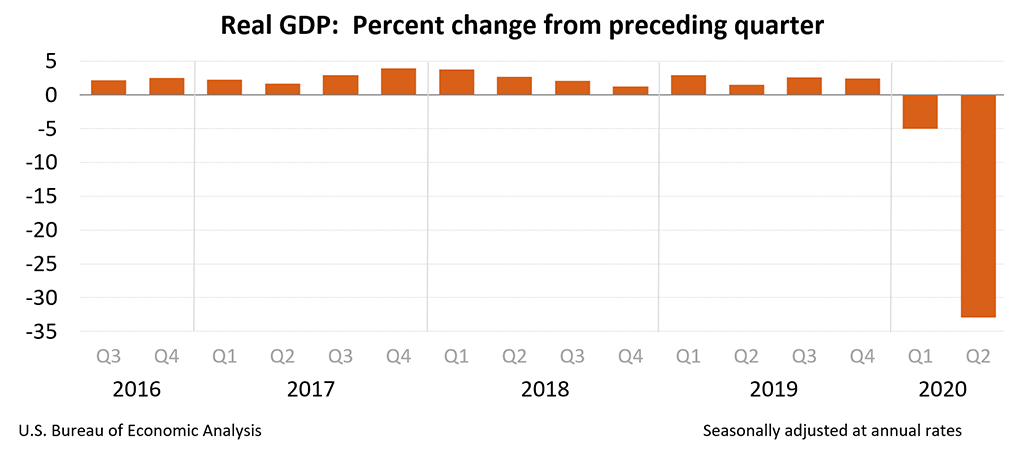

Real gross domestic product (GDP) decreased at an annual rate of 32.9 percent in the second quarter of 2020 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP decreased 5.0 percent.The GDP estimate released today is based on source data that are incomplete or subject to further revision by the source agency (see "Source Data for the Advance Estimate" on page 2). The "second" estimate for the second quarter, based on more complete data, will be released on August 27, 2020.

Coronavirus (COVID-19) Impact on the Second-Quarter 2020 GDP EstimateThe decrease in real GDP reflected decreases in personal consumption expenditures (PCE), exports, private inventory investment, nonresidential fixed investment, residential fixed investment, and state and local government spending that were partly offset by an increase in federal government spending. Imports, which are a subtraction in the calculation of GDP, decreased (table 2).

The decline in second quarter GDP reflected the response to COVID-19, as "stay-at-home" orders issued in March and April were partially lifted in some areas of the country in May and June, and government pandemic assistance payments were distributed to households and businesses. This led to rapid shifts in activity, as businesses and schools continued remote work and consumers and businesses canceled, restricted, or redirected their spending. The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the second quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified. For more information, see the Technical Note.

The decrease in PCE reflected decreases in services (led by health care) and goods (led by clothing and footwear). The decrease in exports primarily reflected a decrease in goods (led by capital goods). The decrease in private inventory investment primarily reflected a decrease in retail (led by motor vehicle dealers). The decrease in nonresidential fixed investment primarily reflected a decrease in equipment (led by transportation equipment), while the decrease in residential investment primarily reflected a decrease in new single-family housing.

Current‑dollar GDP decreased 34.3 percent, or $2.15 trillion, in the second quarter to a level of $19.41 trillion. In the first quarter, GDP decreased 3.4 percent, or $186.3 billion (table 1 and table 3).

The price index for gross domestic purchases decreased 1.5 percent in the second quarter, in contrast to an increase of 1.4 percent in the first quarter (table 4). The PCE price index decreased 1.9 percent, in contrast to an increase of 1.3 percent. Excluding food and energy prices, the PCE price index decreased 1.1 percent, in contrast to an increase of 1.6 percent.

Personal Income and Outlays

Current-dollar personal income increased $1.39 trillion in the second quarter, compared with an increase of $193.4 billion in the first quarter. The increase in personal income was more than accounted for by an increase in personal current transfer receipts (notably, government social benefits) that was partly offset by declines in compensation and proprietors' income (table 8). Additional information on several factors impacting personal income can be found in "Effects of Selected Federal Pandemic Response Programs on Personal Income."

Disposable personal income increased $1.53 trillion, or 42.1 percent, in the second quarter, compared with an increase of $157.8 billion, or 3.9 percent, in the first quarter. Real disposable personal income increased 44.9 percent, compared with an increase of 2.6 percent.

Personal outlays decreased $1.57 trillion, after decreasing $232.5 billion. The decrease in outlays was led by a decrease in PCE for services.

Personal saving was $4.69 trillion in the second quarter, compared with $1.59 trillion in the first quarter. The personal saving rate—personal saving as a percentage of disposable personal income—was 25.7 percent in the second quarter, compared with 9.5 percent in the first quarter.

Source Data for the Advance Estimate

Information on the source data and key assumptions used in the advance estimate is provided in a Technical Note that is posted with the news release on BEA's Web site. A detailed "Key Source Data and Assumptions" file is also posted for each release. For information on updates to GDP, see the "Additional Information" section that follows.

Annual Update of the National Income and Product Accounts

The estimates released today also reflect the results of the Annual Update of the National Income and Product Accounts (NIPAs). The timespan of the update is the first quarter of 2015 through the fourth quarter of 2019 for estimates of real GDP and its major components, and the first quarter of 1999 through the fourth quarter of 2019 for estimates of income and saving. The reference year remains 2012. More information on the 2020 Annual Update is included in the May Survey of Current Business article, "GDP and the Economy."

For the period of expansion from the second quarter of 2009 through the fourth quarter of 2019, real GDP increased at an annual rate of 2.3 percent, the same as previously published.

With today's release, most NIPA tables are available through BEA's Interactive Data application on the BEA Web site (www.bea.gov). See "Information on Updates to the National Income and Product Accounts" for the complete table release schedule and a summary of results, which includes a discussion of methodology changes. A table showing the major current‑dollar revisions and their sources for each component of GDP, national income, and personal income is also provided. The August 2020 Survey of Current Business will contain an article describing the update in more detail.

Previously published estimates, which are superseded by today's release, are found in BEA's archives.

Updates for the First Quarter of 2020

For the first quarter of 2020, real GDP is estimated to have decreased 5.0 percent (table 1), the same decrease as previously published. An upward revision to private inventory investment was offset by a downward revision to exports and an upward revision to imports.

Real GDI is now estimated to have decreased 2.5 percent in the first quarter (table 1); in the previously published estimates, first-quarter GDI was estimated to have decreased 4.4 percent. The leading contributor to the upward revision was compensation, based primarily on new first-quarter wage and salary estimates from the BLS Quarterly Census of Employment and Wages.

The price index for gross domestic purchases is now estimated to have increased 1.4 percent in the first quarter, 0.3 percentage point lower than previously published (table 4). The PCE price index increased 1.3 percent, the same increase as previously published. Excluding food and energy prices, the PCE price index increased 1.6 percent, 0.1 percentage point lower than previously published.

First Quarter 2020

Previous Estimate Revised

(Percent change from preceding quarter)

Real GDP -5.0 -5.0

Current-dollar GDP -3.4 -3.4

Real GDI -4.4 -2.5

Average of Real GDP and Real GDI -4.7 -3.7

Gross domestic purchases price index 1.7 1.4

PCE price index 1.3 1.3

PCE price index excluding food and energy 1.7 1.6

Donald J. Trump for President, Inc.

July 30, 2020

Trump campaign statement on 2nd Quarter economic news

“These economic numbers reflect April through June, when much of the economy was essentially closed down to save millions of American lives. The media is also grabbing onto the annualized number which supposes that the economic conditions will remain the same for an entire year, which it undoubtedly will not. The President’s policies already have the economy rebounding as the jobs reports from May and June show that an incredible 7.5 million jobs were created as lockdowns ended and businesses began reopening. The President has implemented the Paycheck Protection Program, keeping paychecks flowing for more than 50 million Americans. Additionally, retail sales and consumer spending have continued to rise, which are more good signs of a strong recovery. President Trump built the world’s best economy once before it was interrupted by the global pandemic and he will do it a second time. Joe Biden oversaw the worst economic recovery since the Great Depression, supported disastrous trade deals, promoted China’s economic advancement, and now promises to raise taxes on more than 80 percent of taxpayers and strangle job creation with the Green New Deal. To be clear, good news for Americans is bad news for Joe Biden, which is a pathetic position to be in for someone running for president of the United States. In November, voters will know that President Trump is the one to trust on bringing the economy back to greatness.”- Tim Murtaugh, Trump 2020 communications director

Biden for President

July 30, 2020

Statement by Vice President Joe Biden on Q2 Economic GDP and UI Filings

Today, we learned that the last three months were the worst period for economic growth our nation has experienced in the 70 years since we started measuring it —a drop of nearly 33 percent. And the already unthinkably high numbers of American workers filing for unemployment each week continues to go in the wrong direction.The depth of economic devastation our nation is experiencing is not an act of God, it's a failure of presidential leadership. Had President Trump taken immediate and decisive action, tens of thousands of lives and millions of jobs would never have been lost.

And now, Trump is failing to effectively manage our recovery — and Republicans in Congress are refusing to give working families the help they need today. We won’t get our small businesses and our workers back to full strength on denials and magical thinking — it’s going to take concerned, thoughtful, and sustained leadership. Only paying attention to the stock market and ignoring science won’t deliver progress. Giving big businesses even bigger deductions for three-martini lunches won’t help working families keep their health care, put food on the table, or pay their rent.

We’re months and months into this pandemic, and still President Trump has failed to step up and mobilize an all-out response to COVID-19 or to drive a safe and effective recovery. It’s unacceptable. We need to extend meaningful and substantial relief for workers now and ensure our states and local governments are not starved into laying off teachers, first responders, and health workers. We need a massive public health response to save lives and get our economy back up to speed so we can get to work and build back better than before.

We need a president to care, lead, and act.

July 30, 2020

DNC on Today’s Economic Numbers

In

response to today’s release of

second quarter GDP

numbers and weekly unemployment

claims, DNC Chair Tom Perez released

the following statement:

“The only thing more jaw-dropping than these numbers is the incompetence that caused them. Donald Trump inherited a strong economy on the rise. And what did he do with it? He torpedoed it. While Trump continues to claim that the economy is doing tremendous and predicts a rapid recovery, millions of Americans are struggling because he put his ego ahead of our public health, downplayed the virus, and continues to rush to reopen without ensuring it is done safely. Our country is in an economic crisis that Trump keeps making worse. America simply can’t afford four more years.”

GDP fell by an unprecedented 32.9% annualized rate last quarter — more than three times the previous record.

Wall Street Journal: “The U.S. economy contracted at a record 32.9% annual rate last quarter and weekly jobless claims rose to 1.43 million, amid signs of a slowing recovery.”

Yahoo’s Alexis Keenan: “At 32.9%, Q2 annualized contraction marked by far worst plunge ever recorded, based on BEA data spanning back to 1947. Before the pandemic, the worst GDP print on record was in the first quarter of 1958, when GDP fell 10.0% on an annualized basis.”

Unemployment claims rose for the second week in a row, with an additional 1.4 million Americans filing initial claims for unemployment. The total number of Americans receiving unemployment benefits rose by the most in over two months as states pause or rollback reopening plans due to the surge in COVID-19.

Bloomberg: “Initial claims through regular state programs rose to 1.43 million in the week ended July 25, up 12,000 from the prior week, a Labor Department report showed Thursday. There were 17 million Americans filing for ongoing benefits through those programs in the period ended July 18, up 867,000 from the prior week -- the largest increase since early May.”

New York Times: “It was the 19th straight week that the tally exceeded one million, an unheard-of figure before the coronavirus pandemic. And it was the second weekly increase in a row after nearly four months of declines, a sign of how the rebound in cases has undercut the economy’s nascent recovery. Claims for the previous week totaled 1.42 million.”

CNN: “In total, 30.2 million Americans claimed jobless benefits in an array of programs for the week ending July 11.”

Many business closures have now become permanent and millions of jobs are not coming back at all.

Washington Post: “The economic crisis caused by the novel coronavirus pandemic has entered a new phase, with permanent business closures now outnumbering temporary ones, new data shows.”

New York Times’s Peter Baker: “More than 15,000 restaurants in America have closed permanently during the pandemic and as many as 10% of independent operators could shut by year's end.”

Associated Press: “Nearly half of Americans whose families experienced a layoff during the coronavirus pandemic now believe those jobs are lost forever, a new poll shows, a sign of increasing pessimism that would translate into roughly 10 million workers needing to find a new employer, if not a new occupation.”

Manufacturing was in a recession last year and fell even more sharply with the pandemic. As of June, nearly 300,000 factory jobs were lost since Trump took office.

New York Times: “After increasing in the first two years of Mr. Trump’s presidency, the number of manufacturing jobs flatlined last year and fell sharply with the pandemic. As of June, there were nearly 300,000 fewer factory jobs in the United States than there were when Mr. Trump was inaugurated.”

Despite Trump’s promises, millions of jobs were lost under his watch and job growth actually slowed even before the pandemic hit.

FactCheck.org: “7.8 million jobs have been lost — including 7,100 coal mining jobs and 274,000 manufacturing jobs.”

FactCheck.org: “Even in February, when employment was at its highest, Trump was far behind the pace needed to fulfill his campaign boast that he would be ‘the greatest jobs president that God ever created.’ Up until then, the average monthly gain under Trump had been 185,000, while the average monthly gain during the four years before he took office was 216,000.”

AP Fact Check: “Trump never managed to achieve the rates of economic growth he promised in the 2016 campaign. The U.S. economy was not the world’s best in history when this started.”