- 2018

Midterm Elections « April 9, 2018 CBO Report -

The Budget and Economic Outlook: 2018 to 2028

REACTIONS AND ANALYSIS

April 9, 2018

Committee for a Responsible Federal Budget

Analysis of CBO's April 2018 Budget and Economic Outlook

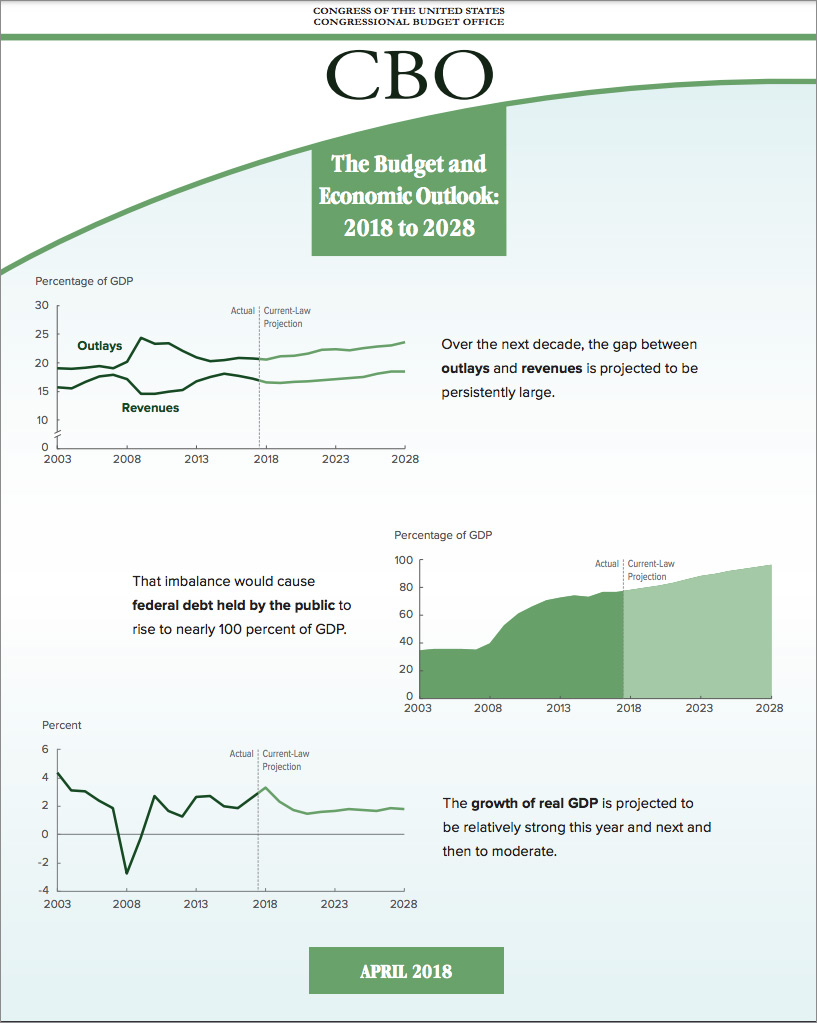

The Congressional Budget Office (CBO) released its ten-year budget and economic outlook today, showing that recent legislation has made an already challenging fiscal situation much worse. CBO’s report projects that:

-

The budget deficit will near one trillion dollars next year, after which permanent trillion-dollar deficits will emerge and continue indefinitely. Under current law, deficits will rise from $665 billion (3.5 percent of Gross Domestic Product) last year to $1.5 trillion (5.1 percent of GDP) by 2028.

-

As a result of these deficits, debt held by the public will increase by more than $13 trillion over the next decade – from $15.5 trillion today to $28.7 trillion by 2028. Debt as a share of the economy will also rise rapidly, from today’s post-war record of 77 percent of GDP to above 96 percent of GDP by 2028.

-

Cumulative deficits through 2027 are projected to be $1.6 trillion higher than CBO’s last baseline in June 2017. The entirety of this difference is the result of recent legislation, most significantly the 2017 tax law.

-

Spending will increase significantly over the next decade, from 20.8 percent of GDP in 2017 to 23.6 percent by 2028. Revenue will dip from 17.3 percent of GDP in 2017 to 16.5 percent by 2019 before rising to 18.5 percent of GDP by 2028 as numerous temporary tax provisions expire.

-

Deficits and debt would be far higher if Congress extends various temporary policies. Under CBO’s Alternative Fiscal Scenario, where Congress extends expiring tax cuts and continues discretionary spending at its current level, the deficit would eclipse $2.1 trillion in 2028, and debt would reach 105 percent of GDP that year – nearing the record previously set after World War II.

CBO’s latest projections show that recent legislation has made an already challenging fiscal situation much more dire. Under current law, trillion-dollar deficits will return soon and debt will be on course to exceed the size of the economy. Under the Alternative Fiscal Scenario, the country would see the emergence of $2 trillion deficits, and debt would reach an all-time record by 2029.

Lawmakers must take prompt corrective action to reverse these deficits. That should include paying for all extensions or new policies, setting reasonable but responsible spending levels, raising new revenue, and reforming major entitlement programs in order to stem the growth of debt.

Deficits and Debt

CBO projects deficits will near the trillion-dollar mark next year and exceed that level every year thereafter. Under current law, deficits will jump significantly in the near term, rising from $665 billion in 2017 to $804 billion in 2018 and $981 billion in 2019. Beyond that, CBO projects nominal dollar deficits to continue to grow steadily to $1.5 trillion by 2028. As a share of the economy, CBO projects deficits will increase from 3.5 percent of GDP in 2017 to 4.6 percent in 2019 and 5.1 percent by 2028.

Under CBO’s Alternative Fiscal Scenario – which assumes many of the 2017 tax law’s expiring provisions and other temporary tax cuts are made permanent, the recent spending deal is extended so that most discretionary spending grows with inflation, and emergency funding for disasters is kept in line with its historical average – deficits will exceed the two-trillion dollar mark by 2028.

Either of these scenarios is substantially worse than what CBO projected in June 2017 prior to the recent tax law and budget agreement. CBO’s previous projections estimated a deficit of $689 billion in 2019, with trillion-dollar deficits not returning until 2022.

CBO’s projections are consistent with those from other forecasters. For example, both CRFB and Goldman Sachs recently estimated budget deficits would reach $1.1 trillion in 2019, and the Treasury’s survey of primary dealers showed a median deficit projection of $965 billion for 2019.

Higher projected deficits, of course, will lead to higher levels of debt. Specifically, CBO projects debt will rise from 76 percent of GDP ($14.7 trillion) at the end of 2017 to 88 percent by 2023 ($21.6 trillion) and 96 percent of GDP ($28.7 trillion) by 2028. Under CBO’s Alternative Fiscal Scenario, debt would reach 105 percent of GDP by 2028, higher than any time in our nation’s history other than in 1946 – immediately after World War II.

These projections are significantly higher than those made in June 2017, when CBO projected debt reaching 91 percent of GDP, or $25.5 trillion, in 2027.

Spending and Revenue

Rising deficits are driven by the disconnect between spending and revenue. Over the next few years, CBO projects spending to rise and revenue to fall as a share of GDP. Over time, CBO projects revenues will recover – both because of the expiration (and instatement) of many provisions in the 2017 tax law and due to real bracket creep that naturally leads revenue to rise – but spending will continue to grow, and revenue will not keep up.

Specifically, spending will increase from 20.8 percent of GDP in 2017 to 21.2 percent in 2019 and 23.6 percent of GDP by 2028. Revenue will decline from 17.3 percent of GDP in 2017 to a low of 16.5 percent by 2019 before rising again to 18.5 percent by 2028. Under the Alternative Fiscal Scenario, spending would reach 24.4 percent of GDP in 2028 while revenue would reach 17.4 percent of GDP.

Spending growth between 2017 and 2019 is driven in large part by a 13 percent, $162 billion nominal increase in discretionary spending. Beyond that, discretionary spending is projected to grow slower than the economy, with a nominal reduction occurring in 2020 after the Bipartisan Budget Act spending increases expire under current law.

Over the course of the next decade, particularly under current law, the vast majority of spending growth will come from health care, Social Security, and interest on the debt. Under CBO’s projections, these three categories account for 81 percent of nominal spending growth between 2017 and 2028 and 144 percent of spending growth as a share of GDP (with other budget categories shrinking).

CBO projects Social Security will grow from 4.9 percent of GDP in 2017 to 6.0 percent by 2028, federal health spending will grow from 5.4 percent to 6.8 percent of GDP, and interest will more than double as a share of the economy from 1.4 percent to 3.1 percent of GDP. Meanwhile, discretionary spending will shrink from 6.3 percent of GDP in 2017 to 5.4 percent by 2028, and other spending will shrink from 2.9 percent to 2.4 percent of GDP.

Under CBO’s Alternative Fiscal Scenario, which assumes the recent budget deal is continued but disaster funding is lower, discretionary spending will remain relatively stable, totaling 5.9 percent of GDP by 2028; interest will rise to 3.3 percent of GDP. Under that scenario, Social Security, health care, and interest will be responsible for 77 percent of nominal spending growth.

On the revenue side, CBO projects individual income tax revenue will remain relatively steady at about 8.3 percent of GDP through 2021, rise gradually to 8.7 percent by 2025, and then rise more rapidly to 9.8 percent of GDP by 2028. Corporate income tax revenue will fall from 1.5 percent in 2017 to 1.2 percent by 2018 before recovering to 1.7 percent by 2025 and shrinking again to 1.5 percent by 2028. Payroll taxes and other sources of revenue will decline slightly as a share of GDP through 2028.

Under CBO’s Alternative Fiscal Scenario, individual income tax revenue would likely remain below 9 percent of GDP and corporate income tax revenue below 1.5 percent. However, these revenue estimates still assume several base-broadening provisions are allowed to go into effect late in the budget window. Absent these provisions, corporate revenue and total revenue would be lower.

Changes in Budget Outlook

Since June 2017, the budget outlook has deteriorated significantly. Last June, CBO projected deficits to total $10.1 trillion between 2018 and 2027; they now project $11.7 trillion of deficits, a $1.6 trillion increase. This increase can be entirely explained by legislation enacted over the past year.

CBO projects legislative changes added $2.66 trillion to deficits through 2027. The largest contributor to this increase is the 2017 tax law, which was originally scored as costing $1.45 trillion before interest on a conventional basis (this initial score is counted as a legislative change). CBO believes the tax bill will increase GDP by an average of 0.7 percent over the next decade and generate roughly $400 billion of revenue and other economic feedback (counted in the economic section). On the other hand, CBO now estimates the tax law will cost over $430 billion more than the Joint Committee on Taxation (JCT) originally scored under conventional scoring practices (counted as a technical change). On net, CBO estimates the tax bill will add $1.89 trillion to the debt through 2027, including interest.

Other than the tax law, Congress enacted several other costly pieces of legislation. CBO estimates $306 billion more in discretionary spending as a result of the Bipartisan Budget Act and omnibus spending bill and another $362 billion from extrapolated changes in uncapped spending.

The Bipartisan Budget Act generally expires after two years and much of the tax bill after eight years. If these laws were continued, it would add over $2 trillion to the deficit through 2027, mostly due to the spending increases.

While legislative changes have worsened the fiscal outlook since June 2017, economic changes have improved them. CBO projects nominal GDP will be 2.4 percent higher in 2027 than what they projected in June. This and other factors result in $1.01 trillion less in deficits. About 0.7 of the 2.4 percent increase and $400 billion of the $1.01 trillion of feedback is the result of the 2017 tax bill.

Other economic revisions, on net, have resulted in additional $570 billion more in revenue and $130 billion less in primary spending, offset in part by $80 billion more in interest payments.

Technical changes have also improved CBO’s fiscal outlook: deficits are $57 billion lower due to technical changes – though the small size of this net improvement is largely due to the $434 billion additional cost CBO estimates for the 2017 tax bill. Other technical changes reduce projected deficits by about $490 billion.

Most significantly, CBO estimates Medicare and Medicaid will spend almost $320 billion less based on the latest data. They also believe agencies will spend appropriated funds more slowly, resulting in $125 billion of lower discretionary spending. In addition, CBO projects almost $50 billion of lower interest spending due to greater issuance of short-term Treasury securities.

Economic Projections

CBO’s budget baseline is built on a new set of economic projections, updated for recent economic data and the effects of the 2017 tax law and other legislation. CBO projects strong near-term economic growth but modest long-term growth.

Real GDP is projected to expand by 3.0 percent this calendar year and by 2.9 percent in the 2019 calendar year, compared to the June 2017 projections of 2.2 and 1.7 percent, respectively.

This rapid near-term growth is driven in part, CBO believes, by a strong recovery, allowing the economy to perform in excess of its long-term potential. In 2019, for example, CBO projects GDP will be a percentage point higher than potential GDP.

CBO believes recent legislation has and will help to provide this boost above potential and to increase potential output. Most significantly, CBO believes the 2017 tax bill will boost growth by about 0.3 percentage points per year over the next three years and ultimately lead to a 1 percent increase in GDP by 2022.

CBO also believes the tax law will have a declining effect over time as it adds to the debt and parts of the law expire or emerge. Between 2023 and 2028, CBO believes the law will slow the rate of GDP growth, leaving total GDP in 2028 about 0.5 percent higher than it otherwise would have been (down from 1 percent in 2022). Other legislation estimated to increase output in the short term would dampen it over the longer term, notably due to larger deficits that would reduce the resources available for private investment.

As a result of this and other effects, CBO estimates real GDP growth of 1.5 to 1.8 percent each year after 2020, with an annual average of 1.8 percent over the 2018-2028 period. This is very similar to the average growth rate projected in June 2017.

Notably, CBO’s projected average growth rate is significantly lower than the roughly 3 percent assumed in the President’s FY 2019 budget. Such rapid levels of growth are far below what others – including the Federal Reserve – have projected; and they are highly unlikely to occur based on available economic evidence. The fact that 3 percent growth could be sustained for two years does not suggest it could be continued indefinitely over the long term.

As the economy expands and deficits grow in the near term, CBO also expects interest rates to rise. They estimate the interest rate on three-month Treasury bills will increase from 0.9 percent in 2017 to 3.8 percent by 2021, and the ten-year bond rate will rise from 2.3 percent to 4.2 percent over that period. This represents a significant increase over prior projections – 1.0 percentage points for the three-month bond and 0.6 percentage points for the ten-year bond. However, by 2027 CBO projects interest rates to stabilize at 2.7 percent and 3.7 percent, respectively, which is similar to its estimates last June.

CBO has also revised down its near-term projections for the unemployment rate. It now projects unemployment to average 3.8 percent in 2018 and 3.3 percent in 2019, compared to 4.2 percent and 4.4 percent projected in its June 2017 outlook, before drifting up to the estimated natural rate of unemployment of 4.6 percent by 2022.

Conclusion

CBO’s latest budget projections confirm what we and others have warned for over a year: recent legislation took a dismal fiscal situation and made it much more dire.

Under CBO’s baseline projections, the deficit will approach $1 trillion next year and exceed that mark every year after. Under CBO’s Alternative Fiscal Scenario, $2 trillion deficits will emerge in just a decade.

The combination of fiscally irresponsible tax cuts and spending hikes, population aging, growing health costs, and rising interest rates will drive the national debt up to 96 percent of GDP under current law and 105 percent under the Alternative Fiscal Scenario. Under either scenario, debt would ultimately well exceed the prior record set just after World War II.

Lawmakers need to reverse course sooner rather than later. The problem will only become more difficult to solve the longer we wait to put our fiscal house in order, and continuing to extend current policies without offsets could do far more damage. Instead, policymakers should enact reasonable and responsible discretionary spending caps, fix the recent tax bill to stem revenue losses, reform our nation’s largest entitlement programs, and enact other tax and spending changes as necessary to put the country on sound fiscal footing.

###

Concord Coalition

Endless Trillion-Dollar Deficits Would Weaken the Nation

WASHINGTON -- The Congressional Budget Office (CBO) today released projections that show sharp increases in the federal deficits and debt over the next decade and beyond. Robert L. Bixby, executive director of The Concord Coalition, issued the following statement:This is the most alarming budget outlook in our nation’s history. “Deficits as far as the eye can see” used to be considered a problem, but we have now reached a remarkable new milestone of fiscal irresponsibility: trillion-dollar deficits as far as the eye can see. What once would have been considered unthinkable is now projected to be routine.

More noteworthy than the sheer magnitude of the projected deficits is the extent to which Congress and President Trump have spent the past year making them worse, approving large deficit-financed tax cuts in December and deficit-financed spending increases last month. No serious effort was made to offset the lost revenue and spending increases.

The consequences of this fiscal irresponsibility are reflected in the alarming projections released today by the CBO in its annual Budget and Economic Outlook.

Under current law, the budget office projects the federal deficit will rise from $804 billion in this fiscal year to surpass the $1 trillion mark in 2020 and reach nearly $1.53 trillion by 2028. Total deficits over the next decade would total nearly $12.42 trillion.

Federal debt held by the public is already quite high by historical standards. The CBO projects that this debt will rise from 78 percent of GDP this year to 96.2 percent in 2028. On this path the debt would continue to rise indefinitely.

Current tax and spending policies are moving the country toward a vicious cycle of rising interest rates and even higher levels of debt. The CBO projects that by 2028 federal interest costs would exceed $900 billion, nearly triple what they are this year in nominal terms, and roughly double as a percentage of GDP.

Even these numbers likely understate the worsening fiscal outlook. The CBO released an alternative fiscal scenario in its report, taking into account changes that more closely represent current policy trends. Compared to the basic scenario, the alternative projects an additional $2.6 trillion in deficits over the next 10 years.

The CBO’s latest projections are hardly surprising. Economists across the political spectrum and the budget office itself have repeatedly warned of the deteriorating fiscal situation. They also warned that the policies approved by Congress and the president in recent months would dig the government into an even deeper financial hole.

The tax legislation alone increased deficits by $1.3 trillion even after taking into account the increases in economic growth it is projected to spur. Interest on that added debtboosts the deficit by another $582 billion.

When looking at these projections relative to CBO’s last projections in June 2017, deficits will be $1.6 higher over 10 years. Legislative actions have combined to increase deficits over that period by $2.7 trillion -- with tax cuts causing 64 percent of the change, spending increases making up 17 percent of the change, and higher interest costs from those policies adding 19 percent. Updated economic projections and technical changes to estimates offset the legislated deficit increases by $1.1 trillion.

Such high and rapidly growing levels of government debt over the next few years would pose a serious threat to the nation’s economy and position of global leadership. The eventual results could include lower living standards, a weaker military and deep cuts in critical government services and investments. Perhaps worst of all, we would be selfishly burdening our children and grandchildren with massive government debt.

The longer we wait, the more painful the solutions will be. The CBO’s new projections are a warning that elected officials in Washington must pursue far more responsible fiscal policies than in the past. If they fail to do so, American voters should be on the lookout for replacements who will.

A copy of this media release can be found here.

The Concord Coalition is a nonpartisan, grassroots organization dedicated to fiscal responsibility. Since 1992, Concord has worked to educate the public about the causes and consequences of the federal deficit and debt, and to develop realistic solutions for sustainable budgets. For more fiscal news and analysis, visit concordcoalition.org and follow us on Twitter: @ConcordC

Progressive Policy Institute

New CBO Report Highlights the Cost of Trump’s First Year

Sen. Bernie Sanders

Sanders Statement on CBO Budget Analysis

WASHINGTON, April 9 – Sen. Bernie Sanders (I-Vt.), the ranking member of the Budget Committee, issued the following statement Monday after the Congressional Budget Office estimated that the cumulative deficit over the next decade will be $1.6 trillion larger than previously projected largely as a result of the tax cuts for the wealthy and large corporations passed by Republicans last year:

"Over and over again, President Trump

and his administration falsely claimed that their $1.5 trillion tax cut

bill would pay for itself. Today’s Congressional Budget Office report

puts that myth to rest. According to CBO, President Trump’s massive tax

break for the wealthy and large corporations is the primary reason that

the federal deficit and national debt will explode over the

next decade. Republicans are already using the huge increase in

the debt that

they caused as an excuse to make major cuts to Social Security,

Medicare and Medicaid. That is unacceptable. At a time of massive

wealth and income inequality, we have got to repeal all of President

Trump’s tax breaks for the wealthy and big corporations and rebuild the

disappearing middle class."

Contact: Josh_Miller-Lewis

Americans for Tax Fairness

FOR IMMEDIATE RELEASE

April 9, 2018

Contact: Jack Pfeiffer

ATF LAUNCHES COMPREHENSIVE WEBSITE ‘TRUMP TAX CUT TRUTHS’

Washington, D.C. - Americans for Tax Fairness today launched a comprehensive website, “Trump Tax Cut Truths,” detailing what American corporations are doing with their Trump tax cuts. The website includes searchable data on more than 830 corporations and where the data exists or can be estimated covers the size of their 2018 tax cuts, amount of stock buybacks announced since the tax law was enacted, estimates of the total value of workers’ bonuses and wages and the number of workers benefitting, job cuts announced, claimed new investments due to the tax cuts and more.

“As Tax Day approaches and Americans across the country file their taxes, the results are as we warned—corporations and their CEOs and wealthy investors are seeing massive tax cuts from Trump’s tax plan, but they are not sharing the wealth with hard-working Americans and their families,” said Frank Clemente, executive director of Americans for Tax Fairness. “Corporations need to be transparent and accountable to their workers, the media and lawmakers, which is why we are launching the ‘Trump Tax Cut Truths’ website detailing what U.S. corporations are doing with their Trump tax cuts.”

How Corporations Are Spending Their Trump Tax Cuts:

- Just 4% of workers are getting one-time bonuses and/or wage increases from their employers -- 6.3 million out of 147.6 million.

- Out of 26 million U.S. businesses, just 383 are providing one-time bonuses and/or wage hikes to their workers for which the cost is able to be estimated.

- Corporations are getting 9 times as much in tax cuts as they are giving to workers in one-time bonuses and in wage hikes -- $60.8 billion vs. $6.5 billion.

- Corporations are spending 37 times as much on stock buybacks, which mostly benefit CEOs and wealthy investors, as they are spending on workers’ bonuses and wages -- $238 billion vs. $6.5 billion.

A report providing the websites key findings and corporate stories is available here; this data will change as information about new corporations gets added. Site visitors can dig into details of a Corporate Tracker page that allows searches by company and provides spreadsheets of data on corporate benefits, shareholder benefits, employee effects, and jobs and investments. The site hosts revealing stories on corporations from Altria and Apple to Verizon and Walmart, which decipher that major claims of corporate generosity from tax cuts are much less than they seem.

“There are too many disingenuous claims that the Trump and Republican tax cuts for corporations will trickle down to the middle class. This website exposes the truths, that President Trump and Republicans gave huge tax cuts to big drug companies, big oil, and other corporations, but corporations are giving back little -- if anything -- to working families,” said Clemente. “In fact, this website reveals that 433 corporations out of the Fortune 500 have announced no plans to share their tax cuts with employees.”

Visit the website “Trump Tax Cut Truths.”

Americans for Tax Fairness is a diverse campaign of more than 425 national, state and local endorsing organizations united in support of a fair tax system that works for all Americans. It has come together based on the belief that the country needs comprehensive, progressive tax reform that results in greater revenue to meet our growing needs. This requires big corporations and the wealthy to pay their fair share in taxes, not to live by their own set of rules.

A Decidedly Different View...

National Republican Congrssional Committee

April 10, 2018 blog post by Erin Collins

Tax Season: Millions of Americans Receiving Raises and Bonuses

As the countdown to Tax Day 2018 continues, it would be impossible to

evaluate the positive effect tax reform is having on our nation without

addressing what happened in its immediate aftermath: companies awarding

raises and bonuses to employees.Though this trend began humbly—just moments after the bill’s signing into law—with Boeing announcing it would award its employees bonuses as a result of tax reform, AT&T quickly followed by making a similar announcement.

Within 48 hours, that list tripled. And almost four months after the passage of tax reform, more than 400 companies have announced similar dividends. That’s more than 4 million Americans—and counting—receiving such benefits thanks to tax reform. All these employee benefits have driven up Americans’ disposable income to its highest level in five years.

Nancy Pelosi may refer to these as mere “crumbs,” but middle-class Americans understand just how far this money goes in their everyday lives.

Similarly, several utility companies have announced they will pass along tax savings to customers. For many Americans, this is a double-win: helping them to both take home more money, and keep more of it.

As tax season continues, one thing is clear: reform is a win for America.

The White House

REMARKS BY VICE PRESIDENT PENCE AT A TAX CUTS TO PUT AMERICA FIRST EVENT

Minneapolis Convention Center

Minneapolis, Minnesota

March 28, 2018

THE VICE PRESIDENT: Wow. Well, hello, Minnesota! (Applause.) It is great to be back in the Twin Cities with men and women who supported the election of a President and a Congress that passed tax cuts to put America first. (Applause.) Thank you for being here.

And I bring greetings. I bring greetings from a friend of mine, and a man who loves Minnesota, and a man who's fighting every day to keep the promises that he made to the people of Minnesota. I bring greetings from the 45th President of the United States of America -- President Donald Trump. (Applause.)

And I want to say thanks to a few folks you've already heard from today. First and foremost, thank you to Congressman Erik Paulsen. Thank you for his leadership. Thanks for those overly generous words in your introduction and thank you for your tireless efforts.

And Congressman Paulsen works on the Ways and Means Committee, and he worked to pass these tax cuts into law. And I want to tell the people of Minnesota, Congressman Paulsen has been fighting every day, shoulder-to-shoulder with President Trump, to make good on all the promises that we made to the people of Minnesota. And we couldn't be more grateful. (Applause.)

And with us today, as you may know, are two more friends of mine. Great members of Congress. Fellow conservatives who, actually, like me, started their careers in radio. They're strong allies of our President in the House of Representatives. Join me in thanking Congressman Jason Lewis and Congressman Tom Emmer. (Applause.)

And I got to tell you, Congressman Jason Lewis has supported our President from the very start. He’s been fighting alongside every step of the way to advance an agenda that’s putting hardworking men and women of Minnesota first.

And Tom Emmer is a fighter who’s working every day for Minnesota miners and working families to protect your right to explore and to mine the precious metal deposits in Minnesota's Iron Range all across this state. Join me in thanking both of these great members of Congress one more time, will you? (Applause.)

I'm also honored to be joined today by a great leader -- a great leader who's long been a champion of American prosperity. He's actually traveling with me today. He's been fighting for American jobs and American workers, and making incredible progress. Join me in thanking Secretary of Commerce Wilbur Ross who joins us in Minnesota today. (Applause.)

And lastly, let me just take a moment to say thanks to our host today. It's an organization that's promoting the policies that are making a real difference in the life of businesses and families all across Minnesota. Let's say thanks to America First Policies for bringing us all together. (Applause.)

But really, I just -- I came here today, mostly, to say thanks, first and foremost, to all of you. Thanks to the good people of Minnesota for all you've done to not only stand with us in the campaign in 2016, but to stand with our administration every day since. Because of your support, I'm here to tell you, you look over the last year and a few months, it’s been a year of action. A year of results. It's been a year of promises made and promises kept. (Applause.) It's true.

You know, and it all starts with providing for the common defense. You know, the first priority of our national government has been -- since our nation's inception -- is protection of the American people. And I'm proud to say, Minnesota is home to many great American patriots serving in the Armed Forces of the United States of America and we couldn't be more proud. (Applause.)

In fact, I'm very honored to be joined today by a group of these heroes from the 934th Airlift Wing of the United States Air Force Reserves. Would you just show these great Americans just how much we appreciate what they do to protect our country every day? (Applause.)

Now, I'm pleased to report to these heroes and to all of you gathered here today, President Trump promised to rebuild our military and restore the arsenal of democracy. (Applause) And five days ago, he did just that when he signed the largest investment in our national defense since the days of Ronald Reagan. (Applause.)

In fact, the Commander-in-Chief just gave our troops the biggest pay raise in nearly 10 years. And under President Trump, the era of budget cuts of our armed forces is over. (Applause.)

Our President has also pledged -- he's also pledged to stand with those who serve in the uniform of the United States. If you're able to stand, would you mind, if you served in one of the armed forces of this country, would you just mind standing on your feet and giving us one more chance to say thank you for your service? (Applause.) Thank you for your service.

President Trump and I have been working hard with these great leaders in the Congress to make sure that we give our veterans access to the world-class healthcare that they earned in the uniform of the United States of America, and we're doing just that. (Applause.)

President Trump also promised to stand with the men and women who serve on the Thin Blue Line of law enforcement. (Applause.) And I'm proud to report to you that we are once again -- we're giving the men and women in law enforcement the resources and the respect that they earn and deserve as they protect our families every day. (Applause.)

Our President promised to secure our borders and enforce our laws for the citizens of this country. And I'm pleased to report to you, illegal crossings at our southern border have been cut by nearly 50 percent. And just last week, President Trump signed into law $1.6 billion of border wall funding that will provide nearly 100 miles of border wall. And when it comes to the wall, make no mistake about it -- we’re going to build it all. (Applause.)

You know, our President also promised to appoint strong conservatives to our federal courts at every level, and we've been busy doing just that. (Applause.) The President appointed Justice Neil Gorsuch to the Supreme Court of the United States. (Applause.) And last year he set a record for the most court of appeal judges confirmed in a single year for any administration in American history. And they're conservatives all. (Applause.)

Closer to home, you know, the President promised to do more than has ever been done to combat the scourge of opiate addiction that's ravaging families here in Minnesota and all across the country. You know, when I was Governor of Indiana, I saw the impact of opiate addiction firsthand. I sat in the kitchen with families still grieving the loss of a loved one, and I sat with recovering addicts and heard about the stranglehold of addiction on their lives that they'd only recently broken free from.

I'm proud to report to you that thanks to the President’s leadership, the strong support of these leaders in Congress, we’re on track to partner with states and law enforcement as never before to invest nearly $6 billion to combat opiate addiction. And working with these leaders in Congress, we will make this the generation that ends the opiate crisis in America. (Applause.)

Finally, in the wake of deadly shootings across our country, our President promised, after Parkland, Florida, that this time, America would take action. And last week, the President took decisive action to improve school safety when he signed legislation to strengthen background checks and give parents, and schools, and law enforcement new tools and new resources to keep our kids safe, because no child should ever be in danger in an American school. And we will continue to make school safety the top national priority of this administration. (Applause.)

So as I report to you what we've done together, I'm telling you, in this White House, it's been about renewed American strength. It's about security. It's about safety in our communities, in our schools.

But what brings us here today is it's also about restoring growth and prosperity for the American people. And since day one of this administration, this President has been keeping his promises to rev the engine of the American economy, and it's working. (Applause.)

The President promised to roll back the heavy hand of government. Some of you may remember, back on the campaign trail, the President promised to repeal two federal regulations for every new federal rule put on the book. And to be perfectly honest with you, we didn't do that. Working with Congressmen Paulsen, Lewis, Emmer, we actually have repealed 22 federal regulations for every new rule put on the federal code -- (applause) -- including when we repealed the disastrous Waters of the U.S.A. rule. (Applause.)

We promised to unleash American energy. And early on in this administration, we approved the Keystone and Dakota Pipelines, we rolled back the Clean Power Plan, and President Trump put America first when he withdrew the United States from the job-killing Paris Climate Accord. (Applause.)

The President also promised to rebuild American infrastructure. If you haven't noticed, you elected a builder to be President of the United States. And just last week, we got a down payment, with the support of these members of Congress -- $21 billion for our plan to give Minnesota and America the best roads and bridges and best future we’ve ever had. (Applause.)

But in the midst of it all, the President has been working to put America first. I’m pleased to report to you, this President has been fighting every day for free, and fair, and reciprocal trade. He's been holding our trading partners accountable for agreements. We've been renegotiating deals. I'm pleased to report to you we’re making great progress on NAFTA. And just yesterday, the White House announced we have reached an agreement, in principle, on a renegotiated free trade agreement with South Korea that will put American jobs and American workers first. (Applause.)

And, finally, what brings us here today. Our President, on that campaign trail, promised to cut taxes across the board for working families, businesses large and small, in the city and on the farm. And just more than three months ago, with the strong support of these leaders in the Congress, President Donald Trump signed the largest tax cuts and tax reform in American history. That’s promises made and promises kept. (Applause.)

You know, it's amazing to think, we’re just one year into this administration, and, frankly, for all that I've just reported to you, all the progress that we've made together with the strong support of these members of Congress you've heard from today and heard about today, the results have been nothing short of remarkable.

Since Election Day, American businesses have actually created nearly 3 million new jobs, including more than 22,000 new jobs in the Twin Cities area alone. (Applause.)

The unemployment rate in this country hasn’t been this low in 17 years. And in 2017, unemployment in the Minneapolis area fell by nearly 20 percent.

And while Minnesota -- (applause) -- get this: While Minnesota lost over a thousand manufacturing jobs in the last year of the previous administration, under President Trump, Minnesota’s factories have bounced back, are booming once again. And since Election Day, businesses across this state have created 7,600 new good-paying manufacturing and construction jobs all across this state. (Applause.) That's just 14 months.

I mean, the truth is, with rolling back regulation, with making the right investments in a growing American economy, with cutting taxes for working families and businesses -- bottom line: Growth is back, confidence is back. Under President Donald Trump, America is back. And we're just getting started. (Applause.) It's true.

But you know, I work with him every day. And I can tell you, for all I just reported to you, that's what this President calls a good start. (Laughter and applause.) He is relentless.

And the truth is, we believe the best days for American growth are yet to come. Because the truth is, most of the tax cuts are just starting to make a difference.

I mean, we cut taxes for Minnesota’s working families so you can keep more of your hard-earned money.

We cut taxes for Minnesota’s businesses, so businesses in this state can now compete and win against businesses anywhere in the world with a lower tax rate. (Applause.)

If you didn't notice it, we also cut out the cornerstone of Obamacare. The individual mandate is gone. It's off the books. (Applause.)

You know, when you add it all together, all told, we think these tax cuts will save the typical family of four here in Minnesota about $3,000 a year in your taxes. And we think they'll unlock new opportunities for businesses to reward employees with higher wages, bigger bonuses, and better benefits.

The truth is, they already are. In fact, we think once all our tax cuts go into effect, that workers here in Minnesota are going to see raises of more than $4,500 a year in the years ahead. (Applause.) Amazing.

And, you know, we’re already on our way. Because in just the past three months, thousands of Minnesota workers have seen bonuses as high as $2,000.

Now folks, that’s great news for working families. But not everybody thinks that. (Laughter.) I mean, you might have heard that the person that wants to be Speaker of the House again –- Nancy Pelosi –-

AUDIENCE: Booo --

THE VICE PRESIDENT: -- when she heard about families getting $1,000 at the end of last year, after the President signed those tax cuts, she actually said a $1,000 bonus for working families was nothing more than “crumbs.” Did you hear it that?

Now, let me remind all of you that Karen and I come from the Joseph A. Bank wing of the West Wing. (Laughter and applause.) You with me on that? Okay. (Applause.)

I mean, really, we've lived on a budget our whole lives. And when our kids were little, we had a term for another $1,000 in the paycheck at the end of the year: Christmas. (Applause.) Am I right?

I mean, the truth is, these bonuses and the pay raises that are already happening all across Minnesota are making a real difference in the lives of families in the Twin Cities and all across this state. And I want to say very seriously: Any leader who says $1,000 in the pockets of working families is crumbs is out of touch with the American people. (Applause.) Okay?

So let me take a moment to thank some leaders that are in touch with the people of Minnesota. These are great leaders in Congress, and I mentioned them before, but I got to mention it again because they were champions of everything that I just described, most especially those tax cuts.

Congressman Erik Paulsen, Congressman Jason Lewis, and Congressman Tom Emmer have been standing with this administration every step of the way. They have been putting America first, and they have been putting Minnesota first. And everything I just described happened because of their leadership and support. (Applause.)

They helped rebuild our military, they helped roll back the reams of federal red tape that I talked about, and they passed these historic tax cuts that are making a difference here in Minnesota. And I know you are as grateful as the President and I are for these extraordinary leaders.

You know, but President Trump and I know, for all of the strong leaders that we work with every day in Washington, D.C., we know that the real strength of this country is not to be found in our nation’s capital. The real strength of this country is not found in the marbled halls of government. But really, the strength and the greatness of this nation has always been found in the hearts and in the character, in the faith, in the work ethic, and the resilience of the American people. And Minnesota is proof of that every single day. (Applause.) It's true.

I mean, the hardworking people of Minnesota have always embodied the American spirit -– from the pioneers who carved a home out of the wilderness, to the patriots who were the first to volunteer to fight for freedom in our nation’s Civil War, to the innovators of every new generation who carry this great state onward and upward.

Minnesota has long been, and is today, America’s “Star of the North.” (Applause.) And that star is helping to lead our nation to a better and brighter future. Today, Minnesota is at the forefront of a great American comeback. You really are.

But, folks, that comeback has only just begun. And I came here today not just to say thanks, not just to give you a report, but also to tell you that we need your continued support to move the President's agenda forward. (Applause.)

So as I close -- as I close, let me say I'm very humbled that you would take time to come out today to see me. And I want to thank each and every one of you for being out.

AUDIENCE MEMBER: Thank you! (Applause.)

THE VICE PRESIDENT: Thank you. I mean, you know, I'm just a small-town boy from Southern Indiana. I dreamed one day of maybe representing my hometown in the Congress. I had the opportunity to serve my state as governor, but I never imagined -- never imagined this grandson of an immigrant would have the opportunity to stand before you as Vice President of the United States of America. And I thank you for your support. (Applause.) And thank you. Thank you.

But I want to encourage you today, before we leave, to take what you've heard here today, keep doing what you did when you made the decision to come out on a Wednesday afternoon -- or morning. (Laughter.) Stay engaged as citizens. Take the energy that, frankly, I've seen in this room this morning, and carry that out from here.

Because the truth is that we've got -- we got our work cut out for us in the days ahead to continue to move this agenda forward. I mean, in every real sense, I encourage you to let your voice be heard.

You know, I'll always believe that, you know, all the cable television networks in the world, all the Internet websites in the world, all the mail pieces, and TV commercials don't matter a hill of beans when somebody who knows you and trusts you hears from you about how important it is to support this President, support this agenda, and support the people that are working with us every day. So go tell somebody. (Applause.) Leave here and tell somebody.

I mean, reach out to coworkers and neighbors, friends at your place of work, and places of worship. And I truly do believe that word of mouth is now, and will always be, the most powerful medium in America.

So I just encourage you to go out and tell somebody what you heard. I mean, say, "I ran into Mike the other day" -- (laughter and applause) -- "and he was telling me all the stuff we've gotten done. And not what the President has gotten done, and not what the Republican majorities in the Congress. What we have gotten done together." And the people who are gathered in this room, people all across Minnesota and across America, stood with this President, stood with these great leaders, and gave us a government that could, in every real sense, turn this country back in the direction of what's always made this country safe and prosperous and strong.

So go tell the story of what's happening in America, among your families, and your friends, and your loved ones. Tell them what they're not hearing on most of their cable television networks. (Laughter.) Tell them about these great congressional leaders; how important it is that we see them continue to have the opportunity to serve and lead. Tell them what we've accomplished, and tell them about the difference that it's making here in Minnesota and all across the country.

I mean, tell them we cut their taxes so they can keep more of what they earn. Tell them we're restoring American strength at home and abroad, standing with our allies, standing up to our enemies. And tell them -- tell them we're once again -- we're once again taking the steps necessary to protect our families in new and in renewed ways.

In a word, tell them we're putting Washington back to work for them -- not the other way around. (Applause.) Tell them President Donald Trump, under this administration, the forgotten men and women of America are forgotten no more. You go tell them that when you leave here today. (Applause.) Because it's true. You tell them that. It's true.

And there’s one more thing I might encourage you to do if you're of a mind. In these challenging times, where there seems to be widening threats abroad and too much division here at home, if you're inclined, from time to time to bow the head and bend the knee, and pray for America, I encourage you to do it. (Applause.) I truly do.

And when you pray, I'm not so much saying pray for a cause or pray for any particular candidate or party. I'm just saying, pray for America, because America matters. Far beyond our shores, the last best hope of Earth. And pray for this great nation, all of its people, and all those who serve her every day.

I truly do believe -- I truly do believe if you continue to do that, if you continue to support this agenda going forward, with your time and your voice, and in every way as good citizens, with these great leaders in the Congress that we've talked about today, with President Donald Trump in the White House, and with God's help, I know we will make America prosperous again. We will make America safe again. And to borrow a phrase, we will make America great again. (Applause.)

Thank you very much, Minnesota. (Applause.) God bless you. And God bless the United States of America.

END 11:00 A.M. CDT