- Cory

Booker

« Affordable

Housing

Cory 2020

June 5, 2019

Cory Booker Announces Comprehensive Plan to Provide Safe, Affordable Housing for All Americans

Cory’s

Renters

Credit Would Benefit More Than 57 Million People and Lift 9.4

Million People Out of Poverty

Plan Also Creates Fund

to Encourage National Right to Counsel for Tenants, Combats

Discrimination in Housing, Fight Homelessness, and More

Newark, NJ - Overwhelming

evidence points to the connection between access to safe, affordable

housing and achieving positive life outcomes. Today, Cory Booker is

unveiling a comprehensive plan to address the housing crisis in America.At the center of the plan is a refundable renters credit for those who are spending more than 30 percent of their before-tax income on housing expenses. According to researchers at Columbia University, the credit would benefit more than 57 million people, including nearly 17 million children, and lift 9.4 million out of poverty. The median participating family would receive a credit equal to $4,800.

“Access to safe, affordable housing can be transformative in the trajectory of people’s lives,” said Cory Booker. “My parents knew this when they moved my brother and me to a New Jersey town with good public schools in the face of racial discrimination. The tenants I represented against slumlords when I first moved to Newark knew it too. So did my neighbors in Brick Towers.

“Making sure all Americans have the right to good housing is very personal to me. I’m determined to tear down the barriers that stand in the way of every American being able to do for their families what my parents did for mine.”

In addition to the renters credit, Cory’s comprehensive housing plan also includes new funding to expand the right to counsel to fight eviction for lower-income tenants, sweeping reforms to restrictive zoning laws, combats discriminatory and predatory practices in the housing market, and addresses homelessness by funding anti-homelessness grants and permanently authorizing the U.S. Interagency Council on Homelessness.

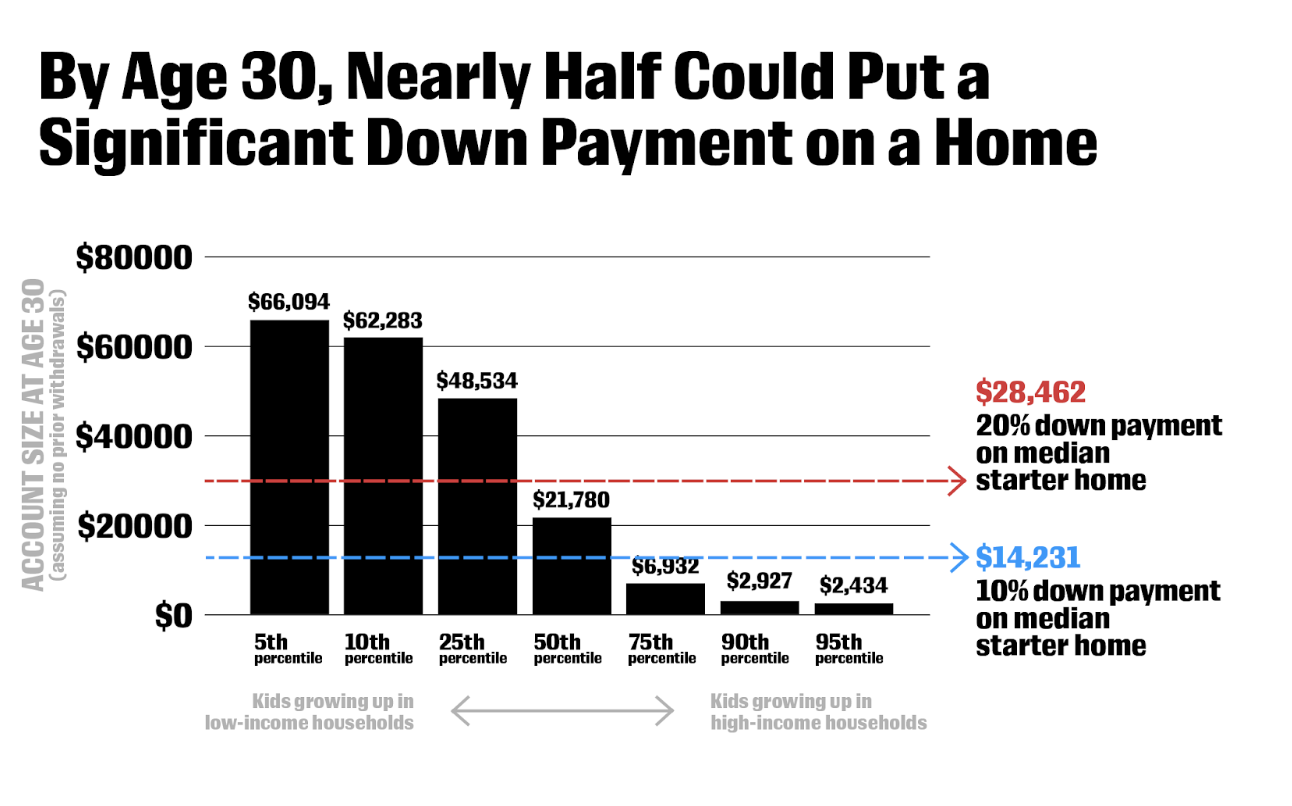

Through Cory’s signature Baby Bonds proposal, the plan also makes homeownership a possibility for more Americans. By age 30, with 62 percent of account holders would have sufficient funds for a 10 percent down payment on the national median starter home and 45 percent would have sufficient funds for a 20 percent down payment.

Read the details of Cory’s full housing plan below:

CORY’S PLAN TO PROVIDE SAFE, AFFORDABLE HOUSING FOR ALL AMERICANS

Helping working Americans cover rent and have a fair shot at homeownership

“Renters credit” to help cap rental costs at 30 percent of income for working- and middle-class Americans. We have a housing affordability crisis in this country. While over 43 million U.S. households rent their homes, there isn’t a single county in America where a full-time worker making the federal minimum wage can afford a two-bedroom apartment at fair-market rent. And the problem is only getting worse: almost half of all renters spend more than 30 percent of their income on rent; in 1960, it was 1 in 5. At the same time, homeownership is increasingly out of reach, with rates of ownership reaching historic lows in recent years. We spend $201 billion each year through the tax code subsidizing homeownership, overwhelmingly benefiting wealthy families. It’s time to act on behalf of renters. Cory will fight for a refundable renters tax credit that would offer relief for individuals and families who are working hard, but still struggling to cover rent at the end of the month. Anyone paying more than 30 percent of their before-tax income would be eligible for the credit, which would cover the difference between 30 percent of a beneficiary’s income and their rent (capped at the neighborhood fair market rent). According to researchers at Columbia University, the impact would be sweeping: the credit would benefit more than 57 million people, including nearly 17 million children, and lift 9.4 million Americans out of poverty. The median credit for a benefitting family would equal $4,800.

Overwhelming evidence points to the connection between access to safe, affordable housing and better health and quality of life.

Examples:

- A person earning the minimum wage ($15,080/year or $1,256/month)

and spending $890/month for a studio in Newark, NJ would receive a

credit of $513 per month¹ under Booker’s proposal -- a more than 40%

increase in her pre-tax income.

- Or consider a working family of five with a combined income of $40,000 living in a three-bedroom home in Cedar Rapids, IA. If they pay $1,350/month in rent -- below average for their neighborhood -- they would receive a monthly credit of $350/month.

A fair shot at homeownership with Baby Bonds. In America, wealth equals opportunity. But decades of discriminatory policy and an upside-down tax code have left millions behind. Cory will establish a new American birthright with his proposal for “Baby Bonds,” creating a federally-funded savings account for every child at birth seeded with $1,000 and that could grow by up to $2,000 every year thereafter depending on family income. By the age of 18, low-income account-holders would have access to nearly $50,000 in seed capital, to do the kind of things that create wealth and change life trajectories, including putting a down payment on a home. According to staff analysis, 62 percent of account holders at age 30 would have sufficient funds in their account for a 10 percent down payment on the national median starter home, and 45 percent would have sufficient funds for a 20 percent down payment.²

Increasing the supply of affordable housing

Push back on zoning rules that limit the supply of affordable housing. Across the country, cities and towns implement land use restrictions that make it harder and more expensive to build new affordable housing. The result is fewer units and higher costs for renters. It is estimated that restrictive land use regulations have lowered access to affordable housing by more than 50 percent from 1964 to 2009. Building on the goals of the 2015 Affirmatively Furthering Fair Housing Rule and his Housing, Opportunity, Mobility, and Equity Act, Cory will incentivize localities to eliminate restrictive zoning rules in order to qualify for billions of dollars of designated federal loan and grant programs at the Department of Housing and Urban Development and the Department of Transportation. Specifically, he will require that the more than $16 billion of current annual funding for the Surface Transportation Block Grant Program, National Infrastructure Investments Program, Nationally Significant Freight and Highway Projects Program, Transportation Infrastructure Finance and Innovation Act Program, Railroad Rehabilitation and Improvement Financing Program, and Community Development Block Grant Program be subject to local governments demonstrating progress towards reducing barriers to affordable housing. Recognizing the chronic underinvestment in our nation’s transportation infrastructure and the lack of access to federal funding at the local level, Cory will also substantially increase funding for both discretionary and formula transportation programs and ensure that local governments that are demonstrating progress towards reducing barriers to affordable housing have greater direct access to federal transportation funding. Local strategies to create a more affordable, inclusive, and diverse housing supply could vary based on individual community circumstances, but may include reduced restrictions on lot size, fewer parking requirements, and allowance of accessory dwelling units and multi-family homes, among others.

Fund construction of new units for low-income renters. Today there is a severe housing shortage for extremely low-income individuals, as developers predominantly build higher-margin luxury units. More than 71 percent of extremely low-income households spend more than half of their income on rent. Cory will fully fund the Housing Trust Fund with $40 billion each year to build, rehabilitate, and operate rental housing for individuals earning less than the federal poverty level or 30 percent of the Area Median Income in neighborhoods with greater access to opportunity, including areas with transportation, healthy foods and more.

Invest in rural America and Indian Country. The problem of housing affordability isn’t limited to cities on the coasts; across rural America and Indian Country, stagnant job growth and flat wages have created an affordable housing crisis. While housing supply is more plentiful, it is often older; for example, an estimated 40 percent of housing on Indian reservations is considered substandard. Cory will properly fund the USDA 515 program, which provides loans to build apartments for low-income residents in rural areas, and the Housing Preservation and Revitalization Demonstration Program, which helps preserve and improve the availability of affordable rental units, and provide essential funding and technical assistance for tribal housing authorities. Finally, Cory will stand up for manufactured and mobile homeowners, which make up 16 percent of owned units in rural areas, including by boosting protections for homeowners and incentivizing landlords to sell the underlying land to mobile park residents.

Combat discrimination and predatory practices in the housing market

Only one in five low-income renter households who needs federal assistance receives it. This affordability crisis has contributed to millions of families facing eviction and homelessness every year. Evictions aren’t just a one-time event -- they send individuals and families into cycles of financial and emotional distress that echo throughout their lives resulting in ongoing struggles to find good housing, worsened employment prospects, mental health problems, and more.

Right to counsel for those who face eviction. While defendants in criminal proceedings have the right to legal representation, tenants facing eviction in most jurisdictions do not, leaving them ill-equipped to effectively defend themselves against unscrupulous landlords or to assert any viable defenses. The problem is worsened by a dramatic imbalance in representation: a recent study found that just 10 percent of tenants are represented by counsel in eviction court, compared to 90 percent of landlords. Lack of access to counsel is particularly problematic for low-income women, especially poor women of color, domestic violence victims, and families with children because they are among those with the highest risk for eviction. Cory will propose a national Eviction Right to Counsel Fund, which will provide funding to states and localities that commit to enacting a right to counsel for low-income tenants facing eviction, following the model of places like New York City, Newark, and elsewhere that have already created such a right. States with tenant protections like just cause eviction laws and adequate notice periods would also be priorities for funding. A recent study evaluating the impact of New York City’s right to counsel law found that evictions declined five times faster in zip codes where right to counsel was in place compared to similar communities where it was not, and that 84 percent of those represented by counsel stayed in their homes. Not only is this policy true to our nation’s values, it is fiscally responsible; a 2016 study estimated that creating a right to counsel for low-income New York City tenants facing eviction would result in $320 million in annual cost savings, attributed to reduced spending on shelters, avoided costs of unsheltered homelessness (like jails), and preserved affordable housing. A similar study in Philadelphia found that spending $3.5 million on a right to counsel for Philadelphia would save the city $45 million a year.

Protect all Americans from housing discrimination. Cory’s parents were able to buy a home in Harrington Park, NJ -- one of the first Black families to do so -- thanks to the protections of the Fair Housing Act. But today, discrimination persists for too many Americans.

- Cory will fight to pass the Equality Act, which would, among other things, amend the Fair Housing Act to outlaw discrimination based on sexual orientation or gender identity.

- He will strengthen federal protections and encourage more states to adopt laws to end “source of income” discrimination, whereby some landlords refuse to rent to individuals and families with housing vouchers. Only about one-third of families with vouchers (34 percent) live in jurisdictions with voucher non-discrimination protections, while two-thirds of voucher holders lack such protection.

- Cory will focus on ending discriminatory practices that make it harder for those with arrest records and the formerly incarcerated to find affordable housing. Nearly 80 percent of participants in a 2015 survey of formerly incarcerated people reported that they and their families were ineligible or denied housing because of their own or a loved one’s conviction history.

Reverse destructive Trump executive actions. Beginning Day 1 in office, Cory will restore the fair housing protections eliminated by the Trump Administration. He will start with the 2015 rulemaking on Affirmatively Furthering Fair Housing, a central mandate of the 1968 Fair Housing Act “to take meaningful actions to overcome historic patterns of segregation, promote fair housing choice, and foster inclusive communities that are free from discrimination.”

End tenant blacklisting. Landlords often blacklist prospective renters who appear in a reporting database as having gone to landlord-tenant court -- even if the renters won their cases. Cory will fight to pass legislation modeled on his Tenant Protection Act, which would prohibit consumer reporting agencies from using information from eviction courts if the tenant has won the case.

Eliminate homelessness

On any given night in the United States, approximately 500,000 people are homeless. Three times that number will find themselves homeless at some point this year. Here, in the wealthiest nation on Earth, we must do more. Not only is it the moral thing to do, it’s fiscally prudent: according to the National Alliance to End Homelessness, the cost to taxpayers of supporting a chronically homeless person is more than $35,000 per year.

Fund anti-homelessness grants. Central to ending homelessness is HUD’s McKinney-Vento Homeless Assistance Grants program, which provides grants to communities to administer homelessness services. Cory would fund McKinney Vento at $6 billion annually -- providing the resources necessary to find, keep safe, and move back into housing anyone in need.

Make the U.S. Interagency Council on Homelessness permanent. The U.S. Interagency Council on Homelessness is a small agency with a large mission -- to coordinate billions of dollars each year in federal funding with the aim of ending homelessness. Every year, the continuation of funding for the agency is uncertain. A permanent authorization of the Council will strengthen its ability to focus on its mission.

Impact of Cory’s Renters Credit by State

¹ Calculation: the small area fair market rent (SAFMR) in Newark is $890. If she found an apartment for $890/month, she would be spending nearly 71% of her income on rent, and would be entitled to a credit equal to the difference between 30% of her income ($377) and her actual rent ($890) -- totaling $513/month.

² Calculations assume that individuals do not withdraw from their accounts prior to age 30 for other eligible uses.

# # #

ICYMI: Cory Booker Announces Comprehensive Plan to Provide Safe, Affordable Housing for All Americans

Newark, NJ — Today, Cory Booker announced a comprehensive plan to address the housing crisis in America by making housing more affordable, expanding help for tenants facing eviction, combating housing discrimination, and much more.Read the full plan here and excerpts of the coverage below:

AP: Booker’s affordable housing plan: Tax credit, zoning changes

Democratic presidential candidate Cory Booker has released a housing proposal that includes a tax credit designed to help make rentals more affordable plus zoning changes and new funding aimed at boosting construction of units for low-income renters.

The New Jersey senator’s plan was released Wednesday and builds on legislation he introduced last year in the Senate that would establish a new refundable renters’ credit. That benefit would kick in to help limit lower- and moderate-income renters’ housing bills to no more than 30 percent of their income.

Booker’s housing plan also includes new spending to help lower-income renters obtain legal representation in eviction proceedings.

Washington Post: Booker proposes capping rent paid by Americans at 30 percent of their income

Under Booker’s plan, anyone paying more than 30 percent of their before-tax income would be eligible for a tax credit, which would cover the difference between 30 percent of their income and the fair-market rent in their neighborhood.

Booker’s campaign pointed to Columbia University research suggesting the median credit for a family benefiting from such a proposal would be $4,800.

[...] Booker’s plan also calls for more funding for rural housing, zoning reforms that he says would spur more affordable housing, and greater legal protections for those facing eviction. It also includes a previously announced “baby bonds” proposal that would give every child a $1,000 bonded savings account at birth. That proposal is aimed at spurring significant savings to afford a down payment on a home.

Booker’s campaign said his plan would be fully paid for by reversing changes to the estate tax under President Trump and raising several other taxes that were cut by the Republican tax law passed in 2017.

CNN: Cory Booker unveils plan to combat housing 'affordability crisis'

Although this marks the first time he has highlighted these proposals as a presidential candidate, it's far from a new policy push for Booker, who has homed in on the issue for decades.

After graduating from Yale Law School in 1997, Booker moved into a public housing complex in Newark called Brick Towers, where he began working as a tenant advocate taking on slumlords. He continued living there as he ran for City Council and later mayor, until shortly before the rundown building was demolished in 2007. He still lives in the same neighborhood today.

But as Booker often mentions on the campaign trail, housing was a personal issue for him even before he moved to Newark. When he was a baby, his parents integrated an affluent New Jersey suburb, enabling his brother and him to attend high-achieving public schools.

In his new plan, Booker would expand the Fair Housing Act to include discrimination based on sexual orientation or gender identity.

New York Times: Cory Booker’s Housing Plan Offers Tax Credit to Millions of Renters

“Access to safe, affordable housing can be transformative in the trajectory of people’s lives,” Mr. Booker said in a statement. “My parents knew this when they moved my brother and me to a New Jersey town with good public schools in the face of racial discrimination. The tenants I represented against slumlords when I first moved to Newark knew it too.”

Mr. Booker has made the fact that he still lives in a poor neighborhood in Newark a key part of his pitch to understanding the struggles of working Americans, touting in his campaign’s announcement video that he is “the only senator who goes home to a low-income, inner-city community.”

Mr. Booker’s housing plan has other elements, including more funding for rural housing and incentives for localities to provide lawyers for those facing eviction.

He has previously announced a proposal he calls “baby bonds,” which would give every child $1,000 in a bonded savings account at birth, with additional government contributions based upon income, in order to lift lower-income families up the ladder of economic mobility. That nest egg, Mr. Booker’s campaign has said, would help increase the number of people who could afford homeownership.

# # #